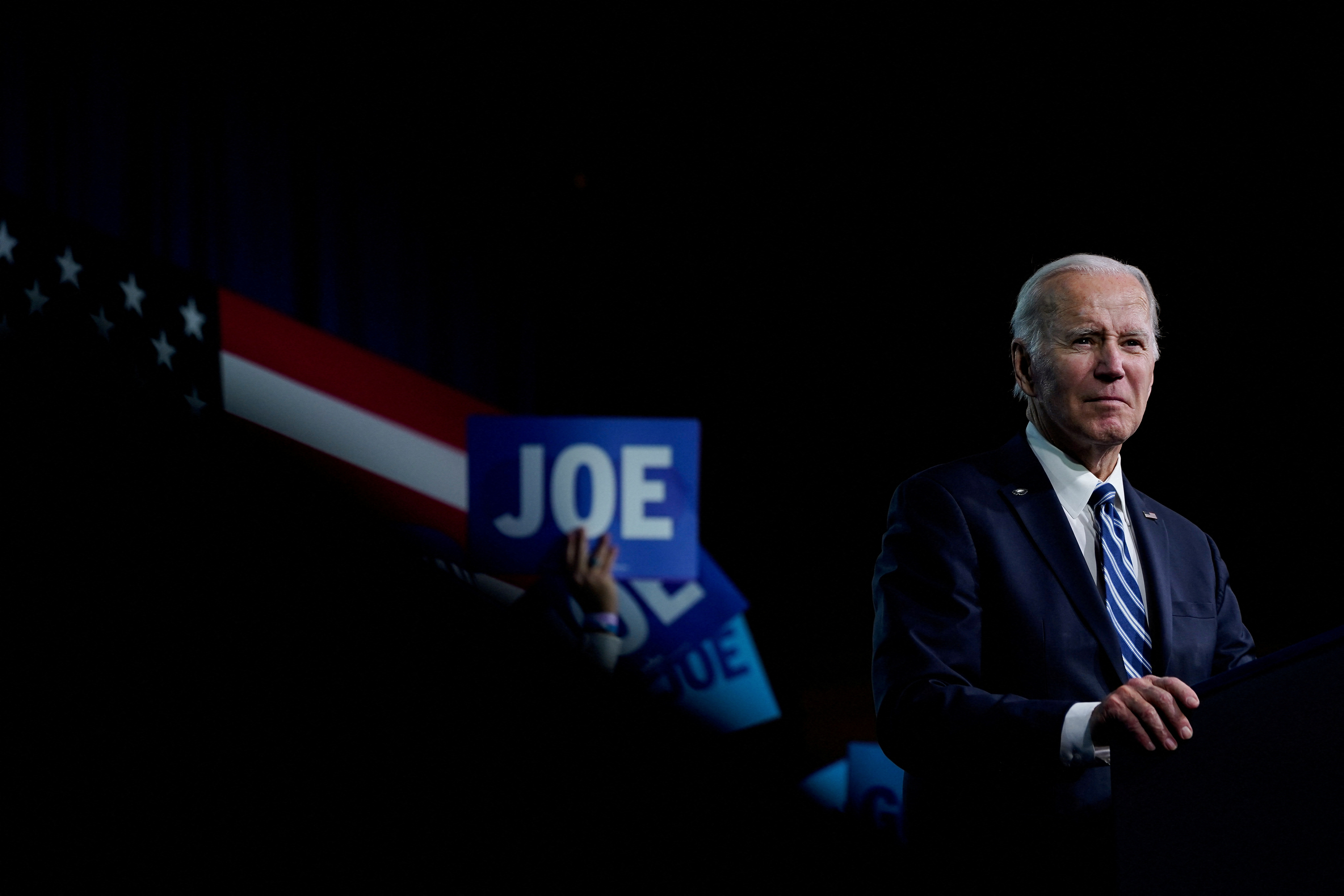

Biden aims to shore up Medicare by taxing high-income Americans

The White House announced that U.S. President Joe Biden will push for higher Medicare taxes on high-earners and more drug price negotiations in order to keep the federal insurance program solvent until at least 2050. This is part of his budget proposal.

His idea quickly ran into opposition in Congress, where Senate Republican leader Mitch McConnell predicted that it would never pass the Republican-controlled House of Representatives.

The White House stated in a Tuesday statement that the tax hike from 3.8% to 5.5% on earned income above $400,000 is part a package of proposals that aims to extend the solvency of Medicare’s Hospital Insurance Trust Fund for at least 25 more years.

Biden wrote separately in a New York Times guest essay published Tuesday that “Let’s ask just a little bit more from the wealthiest, to strengthen Medicare over the long-term,”

|

Biden tried to connect Republicans to the idea that funding for the senior and disabled insurance program could be cut as part of negotiations to increase the United States’ $31.4 billion debt limit. Biden’s Democrats hold the Senate but Republicans hold a narrow majority of the House.

The Democratic President has promised to share his vision for Medicare funding and challenged Republicans to do the same.

McConnell stated to reporters during a press conference, “Thank goodness the House’s Republican.”

“Massive tax increases, increased spending. He said that all of these things, which the American people can be thankful to the Republican House for, will not see the light the day.

On Thursday, the president will unveil his budget. He will also give a speech in Philadelphia to promote his plan.

Biden called the rate hike “modest,” and added in the Times: “When Medicare passed, the richest 1% of Americans had less than five times as much wealth as the bottom 50 percent combined. It only makes sense that adjustments should be made today to reflect this reality.”

The White House stated that his proposal seeks to close loopholes which allow high-earners to protect some of their income from tax.

Democrats passed the Inflation Reduction Act last year. It allows Medicare to negotiate high-cost drug prices. According to the White House, Medicare would be able to negotiate prices for additional drugs, and sooner after their launch, thereby saving $200 billion over 10 year.

The most recent Medicare Trust Fund Report, which was released by the Trustees of Medicare, predicted that the trust fund would become insolvent in 2028 if there were no actions taken.

Some House Republicans believe that Medicare and Social Security should be included in any budget negotiations. These programs provide retirement and disability benefits. The two programs are popular but account for only one-third federal spending according to the Congressional Budget Office. This number is expected to rise as the U.S. population ages.

No Comments