Democrats vote to release six years of Trump’s tax returns

The House’s main tax-writing committee voted Tuesday night to release six years worth of tax returns from former President Trump. This is the culmination years-long Democratic efforts to get Trump’s financial records. Republicans see this as a provocative move as they take control of the House.

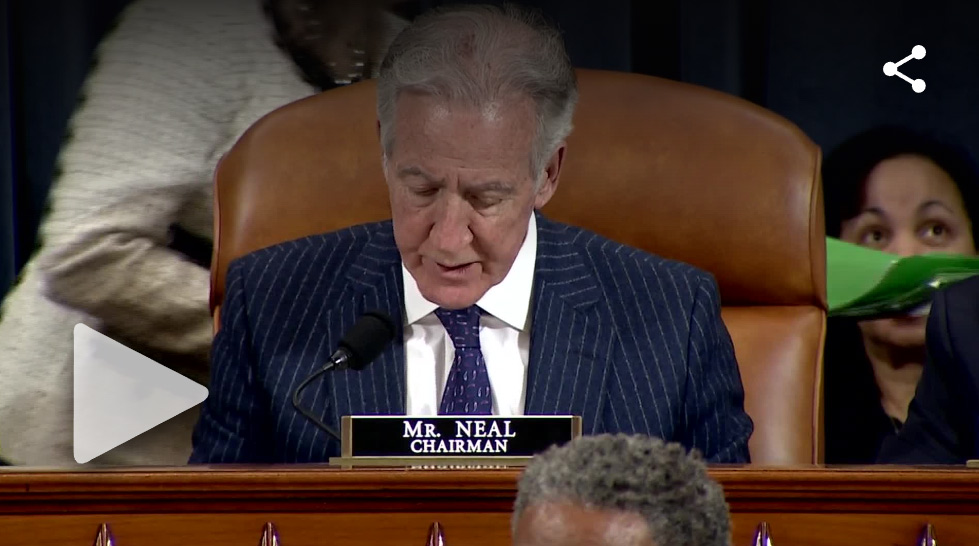

Richard Neal, Ways and Means leader (D-Mass.) said that the returns could be released in a matter of days. After the vote, he said. These returns will be added to a package that includes two reports from Congress’ Ways and Means Committee about the presidential audit system for the IRS.

These reports will be made public this evening. Committee members stated that Trump’s tax returns will be redacted to remove details such as social security numbers and bank accounts. This could take several days.

The substance of the returns is being kept secret by Democrats, as private tax returns are confidential documents that are subject to audit by the IRS. Republican chairman Rep. Kevin Brady (Texas), said that there was no final decision on Trump’s tax owing for these years.

|

Neal stated, “I think that we should leave that to tax people.”

Some Democrats, however, are openly expressing their dismay at Trump’s return.

Rep. Lloyd Doggett (D-Texas), said Tuesday that Trump claimed tens to millions in credits and losses without the type of documentation an ordinary taxpayer would likely provide. Donald Trump was a huge tax payer, with big deductions and credits.

He said that many questions regarding foreign entanglements or conflicts are still unanswered and unknown. He also stated that Trump’s returns showed the need for both new Presidential audit legislation as well as a fairer tax system.

To make the results public, the committee voted on party lines 24-16. Democrats voted in favor, while Republicans voted against.

Republicans condemned the release of the returns and warned that it will herald a new era in disclosing financial information as a “political tool.”

Ways and Means Republican leader Kevin Brady (R.Texas), stated that the meeting “sets a terrible precedent and unleashes an dangerous new political tool that reaches far beyond former president.”

He said, “I will not speculate on the focus of the next Congress or this committee on tax returns. But I do know that the IRS will be a major focus.”

After Tuesday’s decision to release tax returns to the public, progressive groups cheered the Ways and Means Committee.

Frank Clemente, director at Americans for Tax Fairness, stated in a statement that “Tax fairness begins at the top: If the president isn’t paying his fair share of taxes or is abusing tax laws in any other way, the American people can know.”

“Chairman [Richard Neal [(D-Mass.)] Ways and Means Democrats and Chairman [Richard Neal (D-Mass.)] are to be commended for their tireless pursuit of this vital information. He said that they now have to share their efforts with the American people as the ultimate arbiters of acceptable behavior by our elected leaders.”

Legal commentators claim that Democrats will abuse the oversight process by making private tax returns public in a hurry without conducting a thorough assessment of the presidential audit programme that is the real reason for Trump’s return.

Professor Daniel Hemel, New York University Law School, wrote earlier this month that a review of the presidential audit program should be done now and end when the GOP gains control of the House in January.

He wrote that Neal and the House Ways and Means Committee would be unable to stand up to their own credibility and could be seen as manipulating the courts and the public if they released the returns without a thorough review of the presidential audit programme.

Tax experts are skeptical that the documents obtained by this committee can back up years worth of investigative reporting. They also have access to Trump’s financial records, and paint a grim picture of Trump as an individual.

Steve Rosenthal, an analyst at the Urban-Brookings Tax Policy Center said that it could be too little too late. “I expect very little without a deeper probe.”

The New York Times reported in 2020 that Trump had paid no income taxes in the past 10 years. This was largely due to Trump reporting a loss of $916 million on his 1995 tax return. This theoretically allowed him to avoid income taxes for almost 20 years.

Trump broke with decades-old precedent by not making his tax returns public during his presidential campaign. He also declined to make them public after he took office in 2017. Although there is no federal law that requires presidents to release their tax returns, there is an IRS audit policy.

This refusal angered Democrats who were enraged by Trump’s lack of transparency during his presidency and given his public image of a successful businessperson.

Neal requested Trump’s individual returns as well as those of eight of the businesses he owns, after Democrats won the House in 2018. This was part of an oversight probe.

In a 2019 letter, Neal informed Charles Rettig, then-IRS Commissioner that the committee required information about how the IRS audits U.S. Presidents as part its internal procedures. Also, it needed to know how their business dealings are taken into consideration.

Neal wrote that Rettig needed to know the extent of the examination and whether it included a review of the underlying business activities required for reporting on the individual income tax returns.

Federal law protects tax returns of private individuals. However, a section in the tax code permits the Ways and Means Committee access to private returns to perform oversight. These returns can legally be made public by submitting a report to Congress as part of its oversight duties.

The Department of Justice approved Neal’s request for access to Trump’s tax returns in July 2021. It stated that the committee had “sufficient reasons” to request the information.

No Comments