California revises 2023 job growth down from 325k to just 50k jobs as deficit to rise

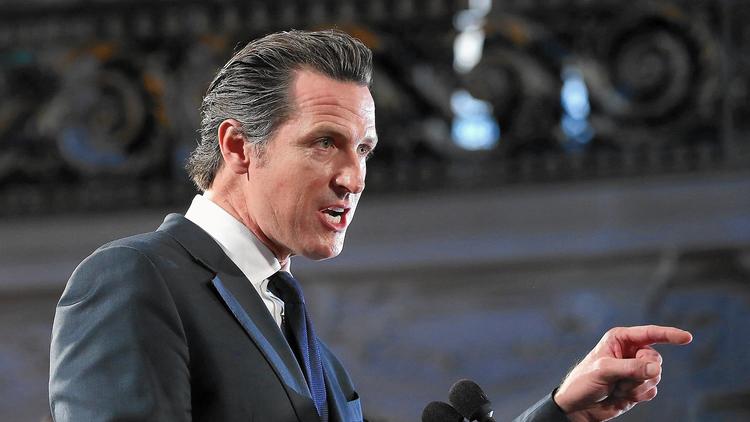

Governor Newsom announced that the downward revision had resulted in lower counts for all sectors except health and government. Newsom proposes $8.5 Billion in cuts, with an expected deficit of $73 Billion.

California has revised its job growth forecast for 2023, from 325,000 to only 50,000 jobs. This suggests that the state’s estimated $73 billion deficit may be larger than previously thought. A rising unemployment rate means that fewer people are paying taxes and more people receive unemployment benefits. This will reduce tax revenue as well as increase spending.

In its revised report, the non-partisan Legislative Analyst’s Office (a state-run agency) stated that “the corrected data shows that the state only added 50,000 jobs” between September 2022 to September 2023. The monthly jobs report that the Administration and the Legislature used to gauge the state’s economy over this period showed that the labor market was growing steadily. It appeared to have added more than 300,000.

All industries, except health and government, saw their counts drop, except professional services, which lost 132,000 jobs. Next, came leisure and hospitality, with 47,000 jobs, then trade, transportation, and utilities, followed by finance, at 36,000. Information was at 33,000. Construction was at 14,000 and manufacturing at 66,000. The revised count showed that the government and health sectors had both gained jobs.

|

According to the LAO, the professional services sector, which includes engineering and technical firms and management consulting firms as well as law firms and accounting firms, is one that tends to hire high-wage earners. Since the top 1%, many of whom are employed in professional services pay 45% state income tax, a decline in this industry could result in significant revenue losses for the state.

Since August 2022 when unemployment rates peaked at 3.8% during the economic recovery following the pandemic, California’s rate of unemployment has continued to rise. In January, unemployment rose from 5,1% to 5,2%. According to the LAO, California’s increasing unemployment in March 2023 triggered the Sahm Rule – a recession indicator. The LAO says the Sahm Recession Indicator has “no wrong positives,” and correctly identified the six U.S. economic recessions since the beginning of time.

Brian Dahle (R-Bieber), when asked about the revision of jobs and its likely impact on the state finances, said that the inability of the Democratic majority to reduce regulations and the failures of government programs is leading to job losses as well as budget problems.

Dahle stated that the majority party “should’ve heeded indicators two, or even three years prior as Californians fled the state.” Dahle said that the majority party is now trying to fix their budgeting mistakes by deferring and raising taxes, when they should be cutting schemes like high-speed rail or Project Roomkey, which cost taxpayers billions.

California’s Democratic Legislature proposed only $2.1 billion of cuts in spending, while California Governor Gavin Newsom proposed $8.5 billion. The state’s $73 Billion deficit is much larger than either of these proposals.

Proposition 58 of 2004 requires the state to adopt a budget that is balanced each year, ensuring that recurrent expenses, such as debt financing, do not exceed revenue. In 45 days, the governor can declare a fiscal crisis to solve the budget issue. The legislature is not allowed to act on other bills until it has passed a budget that is balanced. Prop. Prop.

California’s legislators and governor could be forced to make drastic cuts to the $209 billion budget if revenue expectations continue to fall.

No Comments